Sustainability Reporting and Corporate Performance: The Moderating Role of Corporate Internationalization

DOI:

https://doi.org/10.21512/jas.v12i1.9476Keywords:

sustainability reporting, internalization, corporate performance, non-financial reportingAbstract

This study aims to investigate the relationship between sustainability reporting and corporate performance moderated by the internationalization level of the firms. The sample for this empirical study is collected from the Financial Times Stock Exchange (FTSE)100 firms listed on Bursa Malaysia for a period of nine years from 2011 to 2019. We examine the sustainability reporting based on the Global Reporting Initiative (GRI) standard with the G4 guideline, in which a content analysis method has been employed to obtain the Sustainability Reporting Index (SRI). The moderating variable for this study is the internationalization level, which is proxied by foreign sales generated. The findings demonstrate that sustainability reporting disclosure has no effect on corporate performance. However, internationalization improves corporate performance but serves no moderation role in the relationship between sustainability reporting and corporate performance. We conclude that there is no evidence to substantiate the claim that companies that disclose more in their sustainability reporting perform better, and this may be because Malaysian corporations are still new to non-financial reporting. We believe that although sustainability reporting is costly, sustainability reporting is able to enhance the reputation of firms in the international market. Sequentially, a highly internationalized firm with more sustainability reporting disclosures may bring wealth to the company in the long run.

References

Aguilera-Caracuel, J., Guerrero-Villegas, J., Vidal-Salazar, M. D., & Delgado-Márquez, B. L. (2015). International cultural diversification and corporate social performance in multinational enterprises: The role of slack financial resources. Management International Review, 55, 323–353. https://doi.org/10.1007/s11575-014-0225-4

Al Hawaj, A. Y., & Buallay, A. M. (2022). A worldwide sectorial analysis of sustainability reporting and its impact on firm performance. Journal of Sustainable Finance & Investment, 12(1), 62–86. https://doi.org/10.1080/20430795.2021.1903792

Al Kurdi, O. F. (2021). A critical review of emergency and disaster management in the Arab world. Journal of Business and Socio-Economic Development, 1(1), 31–40. http://dx.doi.org/10.1108/JBSED-02-2021-0021

Amahalu, N. (2019). Effect of sustainability reporting on corporate performance of quoted oil and gas firms in Nigeria. Journal of Global Accounting, 6(2), 217–228.

Attig, N., Boubakri, N., El Ghoul, S., & Guedhami, O. (2016). Firm internationalization and corporate social responsibility. Journal of Business Ethics, 134, 171–197. https://doi.org/10.1007/s10551-014-2410-6

Bartlett, C. A., & Ghoshal, S. (1989). Managing across Borders: The Multinational Solution. Harvard Business School Press.

Bausch, A., & Krist, M. (2007). The effect of context-related moderators on the internationalization-performance relationship: Evidence from meta-analysis. Management International Review, 47, 319–347. https://doi.org/10.1007/s11575-007-0019-z

Brooks, C., & Oikonomou, I. (2018). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. The British Accounting Review, 50(1), 1–15. https://doi.org/10.1016/j.bar.2017.11.005

Buallay, A. M. (2019). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality, 30(1), 98–115. https://doi.org/10.1108/MEQ-12-2017-0149

Buallay, A. M. (2020). Sustainability reporting and bank’s performance: Comparison between developed and developing countries. World Review of Entrepreneurship, Management and Sustainable Development, 16(2), 187–203. https://doi.org/10.1504/WREMSD.2020.105992

Buallay, A., El Khoury, R., & Hamdan, A. (2021). Sustainability reporting in smart cities: A multidimensional performance measures. Cities, 119. https://doi.org/10.1016/j.cities.2021.103397

Chakrabarty, S., & Wang, L. (2012). The long-term sustenance of sustainability practices in MNCs: A dynamic capabilities perspective of the role of R&D and internationalization. Journal of Business Ethics, 110, 205–217. https://doi.org/10.1007/s10551-012-1422-3

Chen, Y., Jiang, Y., Wang, C., & Hsu, W. C. (2014). How do resources and diversification strategy explain the performance consequences of internationalization? Management Decision, 52(5), 897–915. https://doi.org/10.1108/MD-10-2013-0527

Cheung, Y. L., Kong, D., Tan, W., & Wang, W. (2015). Being good when being international in an emerging economy: The case of China. Journal of Business Ethics, 130, 805–817. https://doi.org/10.1007/s10551-014-2268-7

Christmann, P. (2004). Multinational companies and the natural environment: Determinants of global environmental policy. Academy of Management Journal, 47(5), 747–760.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2010). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67. https://doi.org/10.1177/0149206310388419

Corazza, L., Scagnelli, S. D., & Mio, C. (2017). Simulacra and sustainability disclosure: Analysis of the interpretative models of creating shared value. Corporate Social Responsibility and Environmental Management, 24(5), 414-434. http://dx.doi.org/10.1002/csr.1417

Dang, V. T., Nguyen, N., Bu, X., & Wang, J. (2019). The relationship between corporate environmental responsibility and firm performance: A moderated mediation model of strategic similarity and organization slack. Sustainability, 11(12). https://doi.org/10.3390/su11123395

Deegan, C., & Blomquist, C. (2006). Stakeholder influence on corporate reporting: An exploration of the interaction between WWF-Australia and the Australian minerals industry. Accounting, Organizations and Society, 31(4-5), 343-372. http://dx.doi.org/10.1016/j.aos.2005.04.001

Dimitratos, P., Amorós, J. E., Etchebarne, M. S., & Felzensztein, C. (2014). Micro-multinational or not? International entrepreneurship, networking and learning effects. Journal of Business Research, 67(5), 908–915. https://doi.org/10.1016/j.jbusres.2013.07.010

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325. https://dx.doi.org/10.2139/ssrn.94034

Freeman, R. E. (2010). Strategic Management: A Stakeholder Approach. Cambridge University Press.

Friedman, M. (1962). Capitalism and Freedom. Chicago: University of Chicago Press.

Ganesan, Y., Hwa, Y. W., Jaaffar, A. H., & Hashim, F. (2017). Corporate governance and sustainability reporting practices: The moderating role of internal audit function. Global Business and Management Research, 9(4s), 159–179.

Garegnani, G. M., Merlotti, E. P., & Russo, A. (2015). Scoring firms’ codes of ethics: An explorative study of quality drivers. Journal of Business Ethics, 126, 541–557. https://doi.org/10.1007/s10551-013-1968-8

Garg, P. (2015). Impact of sustainability reporting on firm performance of companies in India. International Journal of Marketing and Business Communication, 4(3), 38-45. http://dx.doi.org/10.21863/ijmbc/2015.4.3.018

Grahovar, M. (2010). The role of corporate social disclosure: Trust, reputation or fashion tool? Gothenburg University: https://gupea.ub.gu.se/bitstream/2077/30501/1/gupea_2077_30501_1.pdf

Guthrie, J., & Parker, L. D. (1990). Corporate social disclosure practice: A comparative international analysis. Advances in public interest accounting, 3, 159–175.

Haugh, H. M., & Talwar, A. (2010). How do corporations embed sustainability across the organization? Academy of Management Learning & Education, 9(3), 384–396. https://doi.org/10.5465/amle.9.3.zqr384

Jamil, A., Ghazali, N. A. M., & Nelson, S. P. (2021). The influence of corporate governance structure on sustainability reporting in Malaysia. Social Responsibility Journal, 17(8), 1251–1278. https://doi.org/10.1108/SRJ-08-2020-0310

Javed, M., Rashid, M. A., & Hussain, G. (2017). Well-governed responsibility spurs performance. Journal of Cleaner Production, 166, 1059–1073. https://doi.org/10.1016/j.jclepro.2017.08.018

Jensen, M. C., & Meckling, W. H. (1976), Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360. https://doi.org/10.1016/0304-405X(76)90026-X

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831-880. https://doi.org/10.1111/j.1540-6261.1993.tb04022.x

Johari, J., & Komathy, M. (2019). Sustainability reporting and firm performance: Evidence in Malaysia. International Journal of Accounting, 4(17), 32-45.

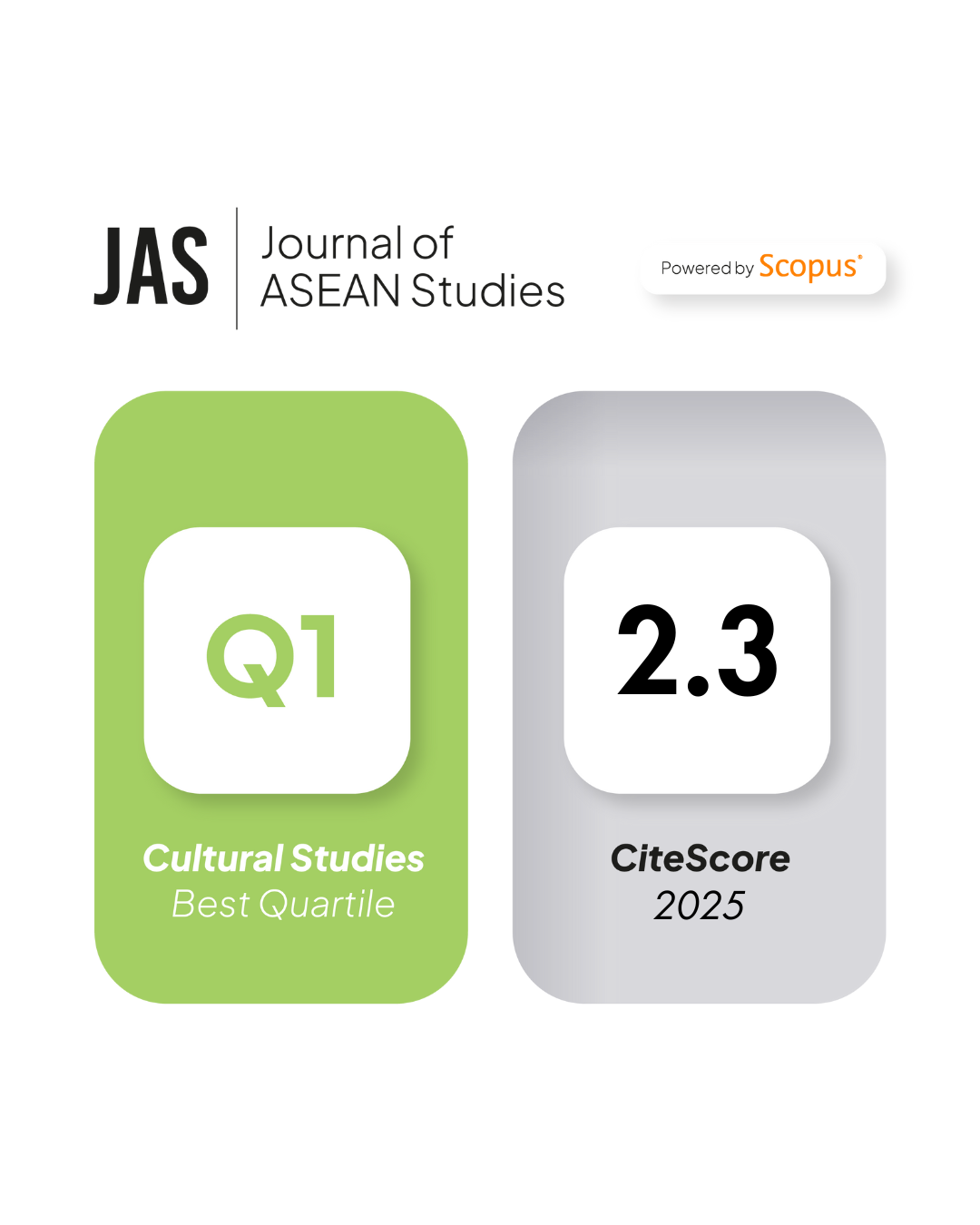

Jonathan, Ariefianto, M. D., & Widuri, R. (2021). The role of financial structure, business drive, business environment on decision to use an external auditor on SMEs: Evidence from ASEAN countries. Journal of ASEAN Studies, 9(2), 159-180. https://doi.org/10.21512/jas.v9i2.7070

Kang, J. (2013). The relationship between corporate diversification and corporate social performance. Strategic Management Journal, 34(1), 94–109. https://doi.org/10.1002/smj.2005

Kasbun, N. F., Teh, B. H., & Ong, T. S. (2016). Sustainability reporting and financial performance of Malaysian public listed companies. Institutions and Economies, 8(4), 78–93.

Khanifah, Hardiningsih, P., Darmaryantiko, A., Iryantik, I., & Udin. (2020). The effect of corporate governance disclosure on banking performance: Empirical evidence from Iran, Saudi Arabia and Malaysia. Journal of Asian Finance, Economics and Business, 7(3), 41–51. https://doi.org/10.13106/jafeb.2020.vol7.no3.41

Kolk, A., & Fortanier, F. (2013). Internationalization and environmental disclosure: The role of home and host institutions. Multinational Business Review, 21(1), 87–114. https://doi.org/10.1108/15253831311309500

KPMG. (2008). International survey of corporate responsibility reporting. https://www.in.kpmg.com/securedata/aci/files/sustcorporateresponsibilityreportingsurvey2008.pdf

Krippendorff, K. (2018). Content Analysis: An Introduction to Its Methodology. SAGE publications.

Laskar, N. (2018). Impact of corporate sustainability reporting on firm performance: An empirical examination in Asia. Journal of Asia Business Studies, 12(4), 571–593. https://doi.org/10.1108/JABS-11-2016-0157

Lee, D. D., & Faff, R. W. (2009). Corporate Sustainability Performance and Idiosyncratic Risk: A Global Perspective. Financial Review, 44(2), 213–237. https://doi.org/10.1111/j.1540-6288.2009.00216.x

Lo, C. K. Y., Wiengarten, F., Humphreys, P., Yeung, A. C. L., & Cheng, T. C. E. (2013). The impact of contextual factors on the efficacy of ISO 9000 adoption. Journal of Operations Management, 31(5), 229-235. http://dx.doi.org/10.1016/j.jom.2013.04.002

Loh, L., Thomas, T., & Wang, Y. (2017). Sustainability reporting and firm value: Evidence from Singapore-listed companies. Sustainability, 9(11), 1–12. https://doi.org/10.3390/su9112112

Luo, Y. (1997). Guanxi and performance of foreign-invested enterprises in China: An empirical inquiry. Management International Review, 37(1), 51-70.

Ma, H., Zeng, S., Shen, G. Q., Lin, H., & Chen, H. (2016). International diversification and corporate social responsibility: An empirical study of Chinese contractors. Management Decision, 54(3), 750–774. https://doi.org/10.1108/MD-07-2015-0322

Mackey, A., Mackey, T. B., & Barney, J. B. (2007). Corporate social responsibility and firm performance: Investor preferences and corporate strategies. Academy of management review, 32(3), 817-835.

Malaysian Code of Corporate Governance. (2021). Securities Commission Malaysia. https://www.sc.com.my/api/documentms/download.ashx?id=239e5ea1-a258-4db8-a9e2-41c215bdb776

Martins, P. S., & Yang, Y. (2009). The impact of exporting on firm productivity: A meta-analysis of the learning-by-exporting hypothesis. Review of World Economics, 145, 431–445. https://doi.org/10.1007/s10290-009-0021-6

Matten, D., & Moon, J. (2008). “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Academy of Management Review, 33(2), 404-424. http://dx.doi.org/10.5465/AMR.2008.31193458

McWilliams, A., & Siegel, D. (2000). Corporate social responsibility and financial performance: correlation or misspecification? Strategic Management Journal, 21(5), 603–609. https://doi.org/10.1002/(SICI)1097-0266(200005)21:5<603::AID-SMJ101>3.0.CO;2-3

Montabon, F., Sroufe, R., & Narasimhan, R. (2007). An examination of corporate reporting, environmental management practices and firm performance. Journal of operations management, 25(5), 998-1014. http://dx.doi.org/10.1016/j.jom.2006.10.003

Oh, H., Bae, J., Currim, I. S., Lim, J., & Zhang, Y. (2016). Marketing spending, firm visibility, and asymmetric stock returns of corporate social responsibility strengths and concerns. European Journal of Marketing, 50(5/6), 838-862. http://dx.doi.org/10.1108/EJM-05-2015-0290

Ohaka, J., & Obi, H. I. (2021). Sustainability reporting and corporate performance: Evidence from listed companies in Nigeria. Nigerian Journal of Management Sciences, 22(1), 190–206.

Oncioiu, I., Petrescu, A. G., Bîlcan, F. R., Petrescu, M., Popescu, D. M., & Anghel, E. (2020). Corporate sustainability reporting and financial performance. Sustainability, 12(10), 1–13. https://doi.org/10.3390/su12104297

Pangarkar, N. (2008). Internationalization and performance of small-and medium-sized enterprises. Journal of World Business, 43(4), 475–485. https://doi.org/10.1016/j.jwb.2007.11.009

Prime Minister’s Office of Malaysia (n.d.). Vision 2020. https://policy.asiapacificenergy.org/sites/default/files/vision%202020.pdf

Sarkis, J., Gonzalez-Torre, P., & Adenso-Diaz, B. (2010). Stakeholder pressure and the adoption of environmental practices: The mediating effect of training. Journal of Operations Management, 28(2), 163-176. http://dx.doi.org/10.1016/j.jom.2009.10.001

Shad, M. K., Lai, F. W., Fatt, C. L., Klemeš, J. J., & Bokhari, A. (2019). Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner production, 208, 415-425. https://doi.org/10.1016/j.jclepro.2018.10.120

Shrivastav, S. M., & Kalsie, A. (2017). The relationship between foreign ownership and firm performance in India: An empirical analysis. Artha Vijnana: Journal of The Gokhale Institute of Politics and Economics, 59(2), 152–162. https://doi.org/10.21648/arthavij/2017/v59/i2/164448

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87(3), 355- 374. https://doi.org/10.2307/1882010

Spence, M. (2002). Signaling in retrospect and the informational structure of markets. American Economic Review, 92(3), 434-459. https://doi.org/10.1257/00028280260136200

Sustainability reporting guide (2nd Ed.). (2018, December 28). https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5cc04d415b711a730ef06262/Bursa_Malaysia_Sustainability_Reporting_Guide-2ndEdition.pdf

Tong, X. F. (2017). A comparative review on company specific determinants for sustainability reporting in United Kingdom (UK) and Malaysia. In The 2016 4th International Conference on Governance and Accountability (2016 ICGA) (Vol. 36). EDP Sciences. https://doi.org/10.1051/shsconf/20173600012

Vendrell-Herrero, F., Gomes, E., Mellahi, K., & Child, J. (2017). Building international business bridges in geographically isolated areas: The role of foreign market focus and outward looking competences in Latin American SMEs. Journal of World Business, 52(4), 489–502. https://doi.org/10.1016/j.jwb.2016.08.007

Wang, G., Zhang, H., Xia, B., Wu, G., & Han, Y. (2020). Relationship between internationalization and financial performance: Evidence from ENR-listed Chinese firms. Journal of Management in Engineering, 36(2).

Wood, L. C., Wang, J. X., Olesen, K., & Reiners, T. (2017). The effect of slack, diversification, and time to recall on stock market reaction to toy recalls. International Journal of Production Economics, 193(10), 244-258. http://dx.doi.org/10.1016/j.ijpe.2017.07.021

Yang, Y., Orzes, G., Jia, F., & Chen, L. (2021). Does gri sustainability reporting pay off? An empirical investigation of publicly listed firms in China. Business & Society, 60(7), 1738–1772. https://doi.org/10.1177/0007650319831632

Zivin, J. G., & Small, A. (2005). A Modigliani-Miller theory of altruistic corporate social responsibility. The BE Journal of Economic Analysis & Policy, 5(1), 1-21. https://doi.org/10.1515/1538-0653.1369

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Josephine Tan-Hwang Yau, Magdalene Sze-Ee Yu, Prihatnolo Gandhi Amidjaya, Audrey Liwan , Jerome Swee-Hui Kueh , Rosita Hamdan

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.