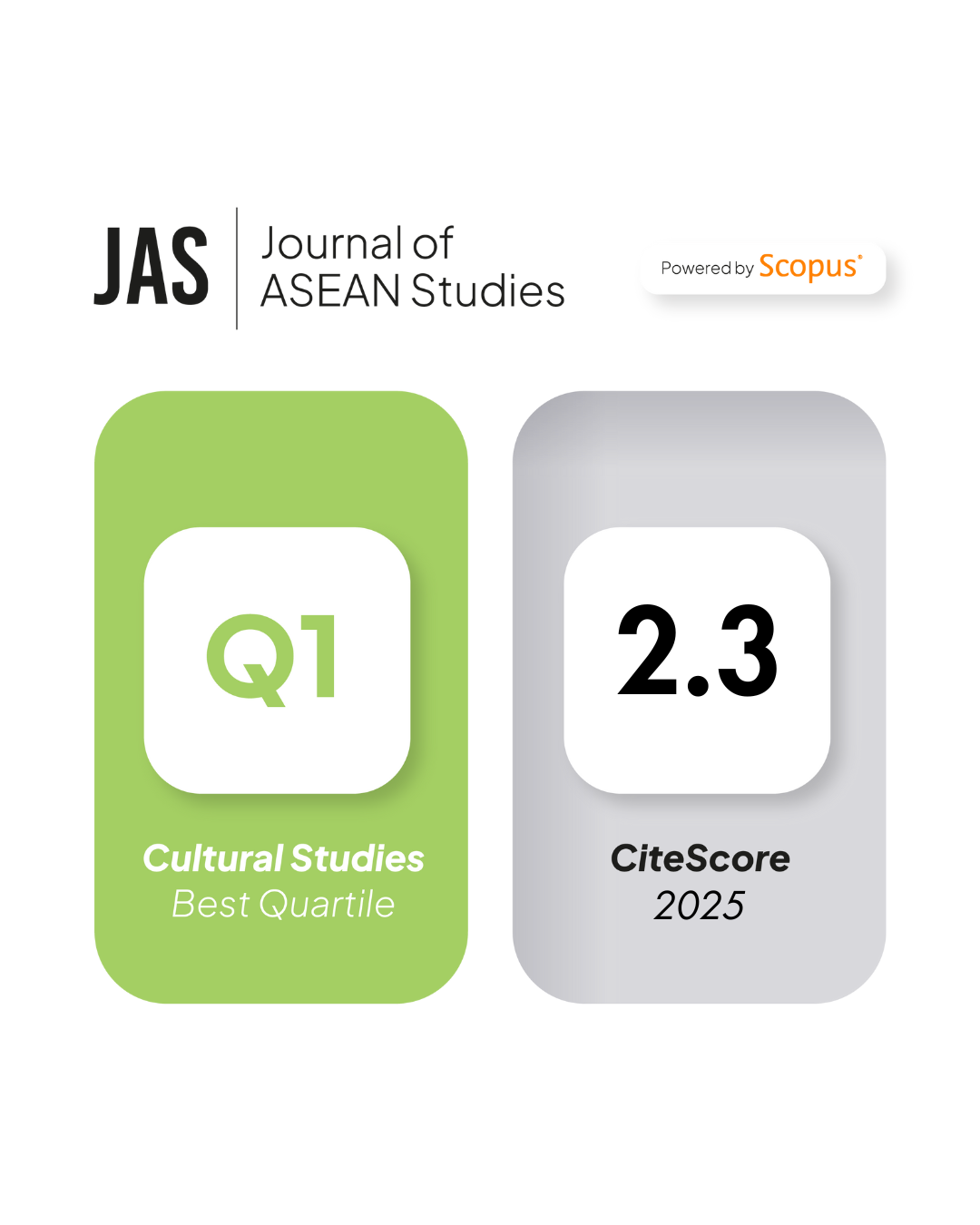

Prerequisites and Perceived Information System Qualities Model for Mobile Banking Adoption Among the Customers of Private Commercial Banks in Myanmar

DOI:

https://doi.org/10.21512/jas.v9i1.6899Keywords:

mobile banking, information system, qualities, private banks, MyanmarAbstract

The research attempts to conjecture the prerequisites of perceived qualities of information system (IS) such as mobile banking (MB). The quantitative research was conducted and a total of 577 MB users of private commercial banks in Myanmar participated in the research. The results of the hypotheses were formulated by using partly exploratory factor analysis (EFA), partly confirmatory factor analysis (CFA), and structural equation modeling (SEM) techniques. The findings expose that device quality is an independent factor, and an antecedent of user interface design quality and system quality. The research also discloses that user interface design quality is a prerequisite of system quality and information quality. In the research, system quality and information quality are key factors affecting customers’ intention to adopt MB. Further, the results confirm that system quality has a statistically significant effect on information quality. However, the effect of device quality on information quality is insignificant. It is expected that the research gives valuable insights for not only bank managers but also software engineers who are going to develop MB systems.

References

Ahn, T., Ryu, S., & Han, I. (2007). The impact of Web quality and playfulness on user acceptance of online retailing. Information & Management, 44(3), 263-275.

Alam, M. M. (2014). Factors Affecting Consumers’ Adoption of Mobile Banking in Bangladesh: An Empirical Study. TNI Journal of Engineering and Technology, 2(2), 31-37.

Ali, M., & Ju, X. F. (2019). The Antecedents of Information System Success in The Banking Industry: An Empirical Investigation of The DeLone and McLean Model. International Journal of Management Science and Business Administration, 5(5), 43-58.

Bahaddad, A. A. (2017). Evaluating M‐Commerce Systems Success: Measurement and Validation of the DeLone and McLean Model of IS Success in Arabic Society (GCC Case Study). Journal of Business Theory and Practice, 5(3), 156-193.

Bharati, P., & Chaudhury, A. (2004). An Empirical Investigation of Decision-Making Satisfaction in Web-Based Decision Support Systems. Decision Support Systems, 37(2), 187-197.

Branscomb, L. M., & Thomas, J. C. (1984). Ease of use: A system design challenge. IBM Systems Journal, 23(3), 224-235.

Brown, I., & Jayakody, R. (2008). B2C e-Commerce Success: a Test and Validation of a Revised Conceptual Model. The Electronic Journal Information Systems Evaluation, 11(3), 167-184.

Chemingui, H., & lallouna, H. B. (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing, 31(7), 574-592.

Clarke III, I. (2001). Emerging Value Propositions for M-commerce. Journal of Business Strategies, 18(2), 133-148.

Comrey, A. L., & Lee, H. B. (1992). A First Course in Factor Analysis (2nd ed.). Hillsdale, NJ: Lawrence Erlbaum.

Damabi, M., Firoozbakht, M., & Ahmadyan, A. (2018). A Model for Customers Satisfaction and Trust for Mobile Banking Using DeLone and McLean Model of Information Systems Success. Journal of Soft Computing and Decision Support Systems, 5(3), 21-28.

DeLone, W. H., & McLean, E. R. (1992). Information systems success: The quest for the dependent variable. Information Systems Research, 3(1), 60-95.

DeLone, W., & McLean, E. (2003). The DeLone and McLean model of information systems success: A ten-year update. Journal of Management Information Systems, 19(4), 9-30.

Deventer, M. v., Klerk, N. d., & Bevan-Dye, A. (2017). Antecedents of attitudes towards and usage behavior of mobile banking amongst Generation Y students. Banks and Bank Systems, 12(2), 78-90.

Everard, A., & Galletta, D. F. (2005). How Presentation Flaws Affect Perceived Site Quality, Trust, and Intention to Purchase from an Online Store. Journal of Management Information Systems, 22(3), 56-95.

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention and behaviour: An introduction to theory and research. MA: Addison-Wesley.

Gao, L., & Waechter, K. A. (2017). Examining the role of initial trust in user adoption of mobile payment services: an empirical investigation. Information Systems Frontiers, 19(3), 525-548.

Graham, M., Hannigan, K., & Curran, P. (2005). Imagine: Visual Design in First-Year Composition. Journal of Visual Literacy, 25(1), 21-40.

Gu, J.-C., Lee, S.-C., & Suh, Y.-H. (2009). Determinants of behavioral intention to mobile banking. Expert Systems with Applications, 36(9), 11605-11616.

Hair, J., Black, W., Babin, B., & Anderson, R. (2010). Multivariate Data Analysis (7th ed.). Upper Saddle River, NJ: Prentice-Hall, Inc.

Hariguna, T., & Berlilana, B. (2017). Understanding of Antecedents to Achieve Customer Trust and Customer Intention to Purchase E-Commerce in Social Media, an Empirical Assessment . International Journal of Electrical and Computer Engineering, 7(3), 1240-1245.

Hofmann, A. (2018). Myanmar’s Banking Sector in Transition Current Status and Challenges Ahead. Bonn and Eschborn, Germany: Internationale Zusammenarbeit (GIZ) GmbH.

Jarvenpaa, S., & Lang, K. (2005). Managing the paradoxes of mobile technology. Information Systems Management, 22(4), 7-23.

Jeong, B.-K., & Yoon, T. E. (2013). An Empirical Investigation on Consumer Acceptance of Mobile Banking Services. Business and Management Research, 2(1), 31-40.

Jeong, H. (2011). An investigation of user perceptions and behavioral intentions towards the e-library. Library Collections Acquisitions and Technical Services, 35(2), 45-60.

Kemp, S. (2020). DIGITAL 2020: MYANMAR. DataReportal.

Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283-311.

Kim, H., Xu, Y., & Koh, J. (2004). A comparison of online trust building factors between potential customers and repeat customers. Journal of the Association for Information Systems, 5(10), 392-420.

Kline, R. B. (2011). Principles and Practice of Structural Equation Modeling (3rd ed.). New York, NY: The Guilford Press.

Koo, C., Wati, Y., & Chung, N. (2013). A Study of Mobile and Internet Banking Service: Applying for IS Success Model. Asia Pacific Journal of Information Systems, 23(1), 65-86.

Kuan, H. H., Bock, G. W., & Vathanophas, V. (2008). Comparing the effects of website quality on customer initial purchase and continued purchase at e-commerce websites. Behavior & Information Technology, 27(1), 3-16.

Kuo, Y.-F., Wu, C.-M., & Deng, W.-J. (2009). The relationships among service quality, perceived value, customer satisfaction, and post-purchase intention in mobile value-added services. Computers in Human Behavior, 25(4), 887-896.

Laukkanen, T. (2007). Internet vs mobile banking: Comparing customer value perceptions. Business Process Management Journal, 13(6), 788-797.

Lee, H.-M., & Chen, T. (2014). Perceived Quality as A Key Antecedent in Continuance Intention on Mobile Commerce. International Journal of Electronic Commerce Studies, 5(2), 123-142.

Lee, K. C., & Chung, N. (2009). Understanding factors affecting trust in and satisfaction with mobile banking in Korea: A modified DeLone and McLean’s model perspective. Interacting with Computers, 21(5-6), 385-392 .

Lin, H.-F. (2007). The Impact of Website Quality Dimensions on Customer Satisfaction in the B2C E-commerce Context. Total Quality Management & Business Excellence, 18(4), 363-378.

Lin, Z., & Theingi, H. (2019). Extended UTAUT2 Model on Factors Influencing of Mobile Commerce Acceptance in Yangon, Myanmar. AU-GSB e-Journal, 12(2), 3-18.

Liu, C. Z., Au, Y. A., & Choi, H. S. (2014). Effects of freemium strategy in the mobile app market: An empirical study of google play. Journal of Management Information Systems, 31(3), 326-354.

Lokman, A. M., Rosely, N. R., Aziz, A. A., & Mokhsin, M. (2017). Trust in Mobile Banking based on DeLone & McLean IS Success Model. International Journal of Control Theory and Applications, 10(25), 299-306.

Lu, H.-P., & Su, P. Y.-J. (2009). Factors affecting purchase intention on mobile shopping web sites. Internet Research, 19(4), 442-458.

Lwin, N., Ameen, A., & Nusari, M. (2019). Mobile Banking Adoption among Customers within Private Commercial Banking Sector in Yangon, Myanmar. International Journal of Management and Human Science, 3(2), 44-59.

Mahad, M., Mohtar, S., Yusoff, R. Z., & Othman, A. A. (2015). Factor Affecting Mobile Adoption Companies in Malaysia. International Journal of Economics and Financial Issues, 5(1), 84-91.

McKnight, D. H., Lankton, N. K., Nicolaou, A., & Price, J. (2017). Distinguishing the effects of B2B information quality, system quality, and service outcome quality on trust and distrust. The Journal of Strategic Information Systems, 26(2), 118-141.

Middleton, C. (2010). Delivering Services over Next Generation: Broadband Networks. Telecommunications Journal of Australia, 60(4), 59-71.

Myo, S. T., & Hwang, G.-H. (2017). Effect of Mobile Devices on the Use Intention and Use of Mobile Banking Service in Myanmar. Journal of Digital Convergence, 15(6), 71-82.

Nelson, R. R., Todd, P. A., & Wixom, B. H. (2005). Antecedents of Information and System Quality: An Empirical Examination within the Context of Data Warehousing. Journal of Management Information Systems, 21(4), 199-235.

Neuman, W. L. (2006). Social research methods : qualitative and quantitative approaches (6th ed.). Boston: Sage, Allyn and Bacon.

Noh, M. J., & Lee, K. T. (2016). An analysis of the relationship between quality and user acceptance in smartphone apps. Information Systems and e-Business Management, 14(2), 273-291.

Parveen, F., & Sulaiman, A. (2008). Technology Complexity, Personal Innovativeness And Intention To Use Wireless Internet Using Mobile Devices In Malaysia. International Review of Business Research Papers, 4(5), 1-10.

Petter, S., DeLone, W., & McLean, E. R. (2013). Information Systems Success: The quest for the independent variables. Journal of Management Information Systems, 29(4), 7-62.

Phuong, N. N., & Trang, T. T. (2018). Repurchase Intention: The Effect of Service Quality, System Quality, Information Quality, and Customer Satisfaction as Mediating Role: A PLS Approach of M-Commerce Ride Hailing Service in Vietnam. Marketing and Branding Research, 5(2), 78-91.

Routray, S., Khurana, R., Payal, R., & Gupta, R. (2019). A Move towards Cashless Economy: A Case of Continuous Usage of Mobile Wallets in India. Theoretical Economics Letters, 9(4), 1152-1166.

Roy, S. (2017). App Adoption and Switching Behavior: Applying the Extended Tam in Smartphone App Usage. Journal of Information Systems and Technology Management, 14(2), 239-261.

Seddon, P. B. (1997). A Respecification and Extension of the DeLone and McLean Model of IS Success. Information Systems Research, 8(3), 240-253.

Shannon, C. E., & Weaver, W. (1949). The Mathematical Theory ofCommunication. Urbana Illinois: University of Illinois Press.

Sharkey, U., Scott, M., & Acton, T. (2010). The Influence of Quality on E-Commerce Success: An Empirical Application of the Delone and Mclean IS Success Model. International Journal of E-Business Research, 6(1), 68-84.

Sharma, S. K., & Sharma, M. (2019). Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. International Journal of Information Management, 44, 65-75.

Talukder, M., Quazi, A., & Sathye, M. (2014). Mobile Phone Banking Usage Behaviour: An Australian Perspective. Australasian Accounting, Business and Finance Journal, 8(4), 83-104.

Tam, C., & Oliveira, T. (2017). Understanding mobile banking individual performance The DeLone & McLean model and the moderating effects of individual culture. Internet Research, 27(3), 538-562.

Tun, P. M. (2020). An Investigation of Factors Influencing Intention to Use Mobile Wallets of Mobile Financial Services Providers in Myanmar. The Asian Journal of Technology Management, 13(2), 129-144.

Tun, P. M. (2020a). Factors Influencing Intention to Reuse Mobile Banking Services for the Private Banking Sector in Myanmar. ASEAN Journal of Management & Innovation, 7(1), 63-78.

Turnell, S. (2011). Fundamentals of Myanmar’s Macroeconomy: A Political Economy Perspective. Asian Economic Policy Review, 6, 136–153.

Venkatesh, V., & Davis, F. D. (1996). A Model of the Antecedents of Perceived Ease of Use: Development and Test. Decision Sciences, 27(3), 451-481.

Wilson, V., & Mbamba, U. (2017). Acceptance of Mobile Phone Payments Systems in Tanzania : Technology Acceptance Model Approach. Business Management Review, 20(2), 15-25.

Yassierli, Y., Vinsensius, V., & Mohamed, M. S. (2018). The Importance of Usability Aspect in M-Commerce Application for Satisfaction and Continuance Intention. Makara Journal of Technology, 22(3), 149-158.

Yeo, J. H., & Fisher, P. J. (2017). Mobile Financial Technology and Consumers’ Financial Capability in the United States. Journal of Education & Social Policy, 7(1), 80-93.

Yoo, J. (2020). The Effects of Perceived Quality of Augmented Reality in Mobile Commerce - An Application of the Information Systems Success Model. Informatics, 7(2), 1-14.

Zhou, T. (2011). An empirical examination of initial trust in mobile banking. Internet Research, 21(5), 527-540.

Zhou, T. (2012). Understanding users' initial trust in mobile banking: An elaboration likelihood perspective. Computers in Human Behavior, 28(4), 1518-1525.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2021 Phyo Min Tun

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.